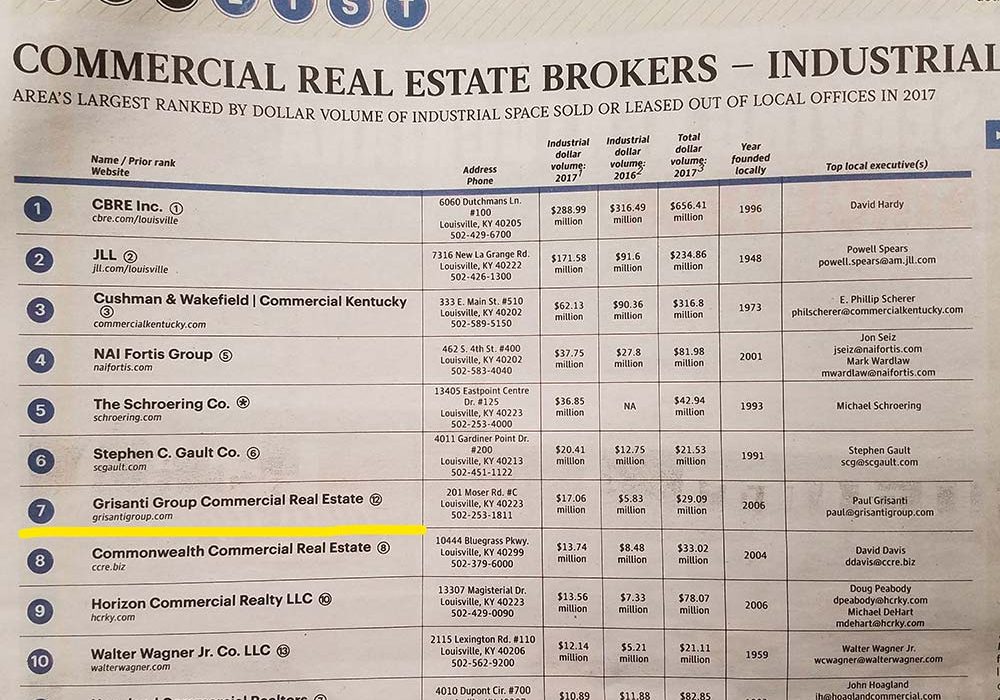

In mid-2019, news broke that prominent Louisville entertainment venue Noah’s Event Venue was in financial trouble, leaving many brides and grooms in the lurch. Like these would-be married couples, the landlords of Noah’s facilities across the country were being victimized as well. It seems they had been pulled into an alleged Ponzi scheme that is now being litigated in federal court. The owners of the Louisville Noah’s building, which is situated in Blankenbaker Station on Plantside Drive, were a group of more than 20 unrelated investors from around the United States. These owners reached out to Paul Grisanti of Grisanti Group Commercial Real Estate to assist with the disposition of the real estate when it became evident that their tenant, Noah’s, was insolvent. After months intense negotiations and the challenging logistics of executing contracts and closing documents among 23 separate and remote parties, Grisanti Group facilitated the completion of sale of the property. The new owner, Hollenbach-Oakley, plans to re-purpose the facility into office space.

This was one of the most challenging transactions on which Grisanti Group has ever worked. The greatest complicating factor was the ownership structure: Tenancy-in-Common (TIC). Most multi-party ownership groups are structured as partnerships, corporations, or LLCs that have corporate bylaws giving a single individual legal signing authority. In a TIC structure, every party must sign all documents, including contracts, amendments, closing statements, deeds, etc. And these 23 parties were not all simply individuals. Some were single people, some were husband and wife, some were trusts, some were LLCs, and so on. Gathering 23 sets of signatures on every document added complexity to every phase of the transaction. Grisanti Group’s good working relationship with a local real estate attorney, Larry Abrams, was vital to getting the deal to the finish line. Additionally, as a triple net tenant, Noah’s had previously been responsible for all aspects of property maintenance and management. However, once Noah’s defaulted, the owners had to step in and take care of the property. Due to the remote and passive nature of the owners, they enlisted Grisanti Group to manage the property during the transaction. Grisanti Group managed the security, utilities, lawn, landscaping, and other property issues during the course of the transaction.

While the deal was a challenge, Grisanti Group shines during complex transactions. We pride ourselves on attention to detail and providing exceptional service from the beginning of the listing agreement, to the contract, to the closing table, and beyond.